Are Diamonds a Good Investment? Auction Results Say Yes!

Would you ever consider buying a rare diamond during a global pandemic?

Historically, people have often put their money into diamonds and gems during turbulent times because stones of exceptional quality are a reliable form of currency in every country. And recent auction results affirm that diamonds remain a solid asset, COVID-19 and all.

“Diamonds are the most portable form of wealth, and that has always been true,” says Rahul Kadakia, Christie’s International Head of Jewelry. “You cannot take a painting with you and you can’t move a building; a diamond is the only way you can move $100 million in your pocket.”

“It’s a good moment to make smart purchases and put the stones away until we can wear them.”

Rahul Kadakia, Christie’s

While much of the world was stuck at home this past June, Christie’s took a risk when it offered an exceptional 28.86 carat D-color diamond for sale online. With a presale estimate between $1,000,000 and $2,000,000, this was the most expensive jewel that the auction house had ever presented in this medium. The risk paid off: there were 31 bids from buyers around the world and it sold—sight unseen—for $2.1 million, a world record price for a jewel sold online.

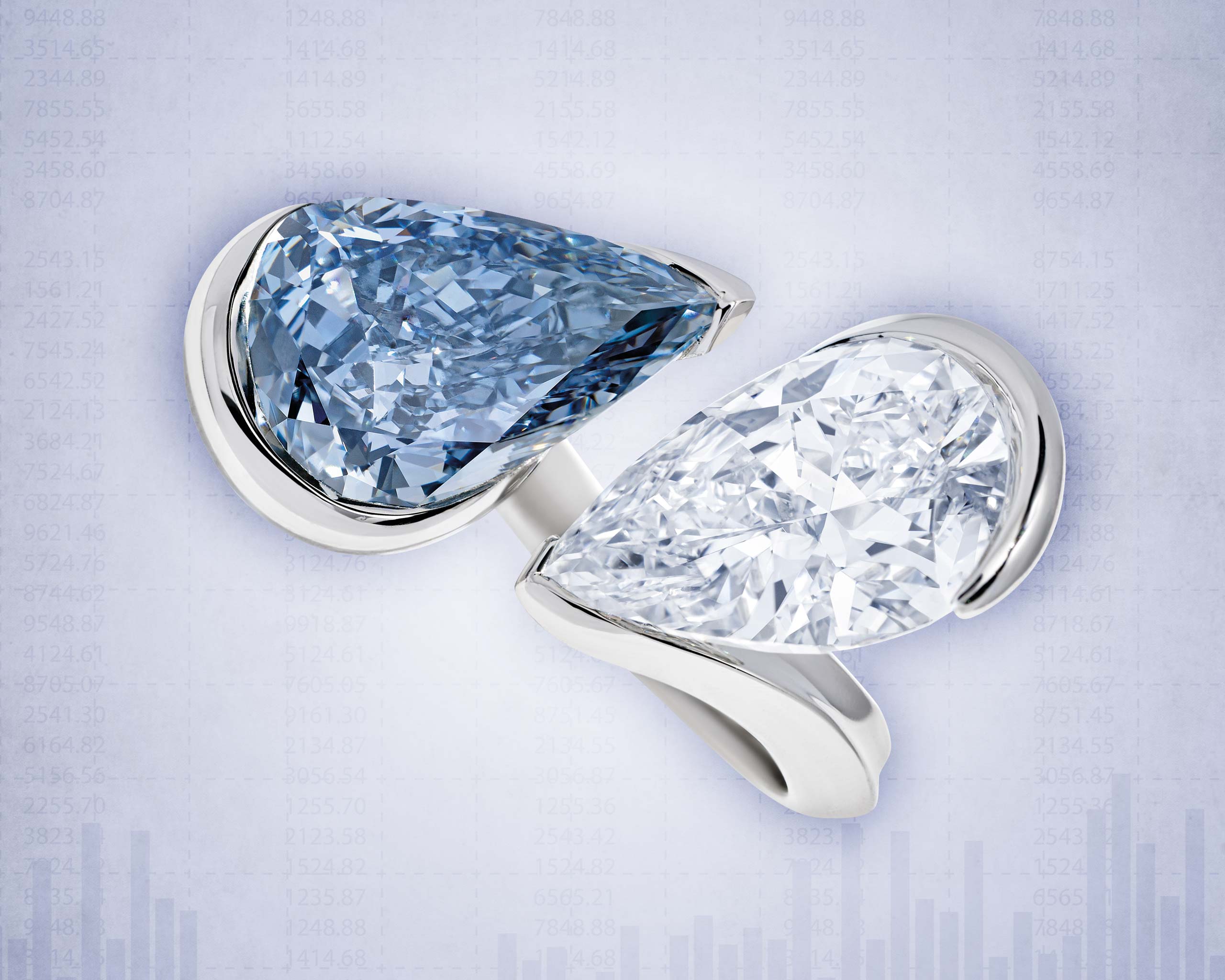

This was one of several multimillion-dollar diamond transactions at Christie’s during the first six months of 2020; at the house’s Magnificent Jewels sale in Geneva in July, a twin stone Reza ring with a 5.34 carat fancy blue diamond and a 5.37 carat, D-colorless diamond sold for $9.2 million. At the same sale, a 100.85 carat, D-color, internally flawless diamond sold for $5.9 million. Meanwhile in New York, a diamond necklace including a pear-shaped 116 carat F-color diamond sold for $6.3 million.

Kadakia believes that buyers are especially motivated now because they can find good value in diamonds at auction. Also, buying from a reputable auction house like Christie’s, which has been around for more than 250 years provides added client assurance, even if they’re buying a stone from far. “It’s a good moment to make smart purchases and put the stones away until we can wear them,” Kadakia says, referring to the fact that many people around the world are still under some sort of quarantine.

Sotheby’s also had stellar jewelry sales in the first half of 2020, with diamonds delivering big results. At its Hong Kong sale on July 10th, the auction house sold two extraordinary stones: a 5.04 carat fancy vivid blue diamond ring for $10.5 million, and a 4.49 carat internally flawless fancy vivid pink diamond ring for $8.1 million. “The hottest color diamonds in the most romantic of cuts and settings proved irresistible, with the pair of fancy vivid pink and blue rings taking top billing as the stars of the show,” said Wenhao Yu, Deputy Chairman, Jewelry, Sotheby’s Asia.

But the biggest sale of the season by far was at Christie’s Hong Kong in July, when a 12.11 carat internally flawless fancy intense blue diamond sold for $15.9 million, far beyond its eight to $12 million presale estimate. “It sold after 15 minutes of active bidding,” says Kadakia. “This exceptionally rare diamond was originally purchased in the 1980s and hadn’t been on the market before,” he explains. “The seller knew he had a treasure.”

Looking back over the past two decades, the prices of “blue chip” diamonds (i.e. D-flawless and fancy colored diamonds) have skyrocketed and generally surpassed the S&P 500 in terms of rate of return.

“Trading at the high end of the diamond market is comparable to the high end of the real estate market where prime locations retain their value irrespective of broader market conditions including scarcity of properties and desirability,” says Paul Redmayne, Head of Private Sales, Jewellery at Phillips. “[And] from a buyer’s perspective, auctions—the neutral intermediary between global buyers and sellers—are the truest indication of market price.” he continues. Diamond sales at auction offer a transparent view of the value of stones, and the type of stones that are in demand. Clearly, the winners are colored diamonds and large D-flawless stones.

Redmayne goes on to explain that “Diamonds at this level (fancy colored diamonds and diamonds over 10 carats) are considered a free-standing asset class. And having seen the appreciation in such stones over the past 15 years, diamond funds, private individuals and family offices have branched out to include them in their portfolios.” He also points out that people are increasingly turning to invest in alternative assets like diamonds alongside their “traditional” portfolio.

Case in point: the 14.6 carat blue diamond (the size of a small grape), which sold at Christie’s for $57.5 million in 2016.

“Buyers are particularly confident when buying diamonds over other gems and jewels, because a GIA certificate validates the stone’s quality,” Kadakia says. “A D-flawless diamond is a D-flawless in Dubai, Dallas or Denmark,” says Kadakia, alluding that diamonds are a coveted currency in every country.

However, not everyone is thinking about a return on their investment when buying a diamond. Since the beginning of time, man has been fascinated and captivated by beautiful natural diamonds and that hasn’t changed. “I think demand is a by-product of a passion for beauty:people have seen that the price to replace the important stones that they already own has increased significantly and as a result they’ve actively pursued this existing passion and predilection for stones,” says Redmayne.

One of Phillips’ biggest diamond sales of the year was a Harry Winston D-color, potentially internally flawless 23.55 carat diamond ring, which sold for $1.3 million at its Hong Kong sale in July. Redmayne observed, “It was such a beautiful stone with amazing provenance, coming as it did from a distinguished European family.”

These big-ticket diamond sales are giving collectors further confidence to invest in top-quality stones as both an asset and a luxury purchase to enjoy that will still hold its value. As Kadakia noted, there is no greater portable asset. “I love the feeling of walking around the office with $10 million to $15 million in my pocket.” Only a diamond can deliver that.